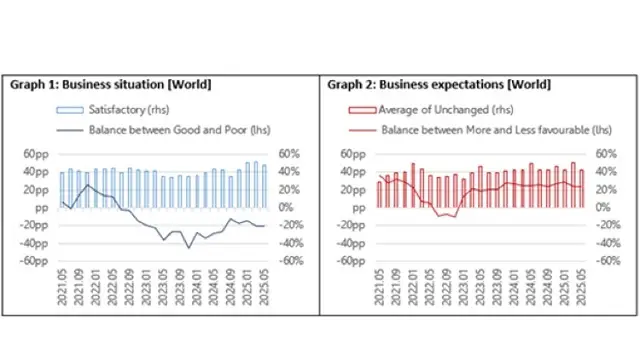

The International Textile Manufacturers Federation (ITMF) released its latest Global Textile Industry Survey on June 17, 2025, revealing a global textile market caught in a holding pattern—neither collapsing nor recovering robustly . Order intake has declined for four consecutive months, while capacity utilization remains steady at about 72–73% in May 2025.

Demand weakness continues to dominate industry fears, cited by roughly 62% of respondents, closely followed by geopolitical concerns and rising input costs. Inventory levels are creeping upward—particularly among yarn producers—yet order backlogs remain resilient, hovering around 2.2–2.5 months across regions.

Regional performance varies sharply. Africa and South America show the most upbeat indicators, with Africa reporting over 20 percentage points of positive business sentiment, while South America leads January optimism with a +21pp balance and strong recovery in order intake. In contrast, North America and East Asia are lagging: Europe and East Asia face declining orders and subdued forecasts, though North America holds relatively firmer outlooks .

Despite these headwinds, the mid-to-late 2025 outlook is cautiously positive. Nearly 43% of respondents expect improved conditions in the next six months, reflecting a tentative rebound mentality.

Bottom line: The global textile industry remains in a critical stall—plagued by weak demand and growing costs, but holding its ground thanks to stable production and resilient order backlogs. Regional disparities suggest pockets of recovery, especially in Africa, South America, and segments like garment and fiber producers.

Analysis for stakeholders:

-

Demand revival is essential—brands and mills must innovate, optimize, and diversify to regain momentum.

-

Regional agility is key. With Africa and South America showing stronger demand and confidence, strategic shifts might gain traction.

-

Operational resilience remains a priority. Maintaining capacity utilization amid sluggish orders suggests a focus on efficiency and inventory control.

As the textile market navigates this standstill, the near-future recovery will hinge on how quickly demand strengthens and how flexibly regions respond.