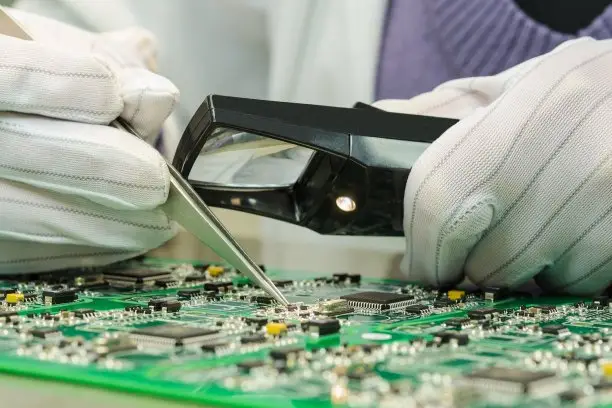

Rising demand for anti‑static protective clothing stems from rapid growth in the electronics industry and a sharpened focus on workplace safety, according to Textiles Intelligence’s new report, Anti‑static Technologies for Performance Apparel: Opportunities in a Fast‑Growing Market. Industrial facilities handling sensitive electronics face serious risks from static discharges—even minor shocks can damage components or trigger fires. Since people are the primary source of static build-up, anti‑static garments have become essential, particularly in electronics and computer manufacturing.

Market research shows anti‑static clothing—including fibers, yarns, fabrics, and finished garments—is valued at around USD 2.6 billion in 2023 and is projected to grow to USD 4.8 billion by 2030, at a CAGR of about 7.1% . Verified Market Reports confirms that electronics manufacturers accounted for roughly 40% of this demand, followed by pharmaceuticals, oil & gas, and automotive industries.

Key suppliers of anti‑static fabrics used in protective apparel include Burlington Fabrics, Carrington Textiles, DuPont, K&K, Klopman International, and TenCate Protective Fabrics. Many flame‑resistant textiles also incorporate anti‑static properties, often embedding conductive elements like carbon, copper, graphene, silver, or stainless steel within the yarn.

Regional trends reinforce rapid expansion in Asia‑Pacific—regions like China and India lead growth thanks to booming electronics manufacturing, lower-cost production, and rising regulatory standards. In 2023, North America captured roughly a third of market share, followed by Europe and Asia‑Pacific; analysts expect Asia to grow fastest thanks to industrialization and safety reforms.

Beyond electronics, anti‑static apparel is expanding in healthcare, pharmaceuticals, aerospace, and automotive sectors where static control matters for equipment integrity and worker safety. The sector shows growing adoption of ergonomic designs and smart textiles—such as sensors or conductive fibers—to deliver both comfort and high ESD protection.

As manufacturers prioritize performance, and the production base shifts toward Asia, the competitive landscape may evolve rapidly. Suppliers investing in sustainable materials, smart integration, and region-specific solutions stand to lead market transformation.