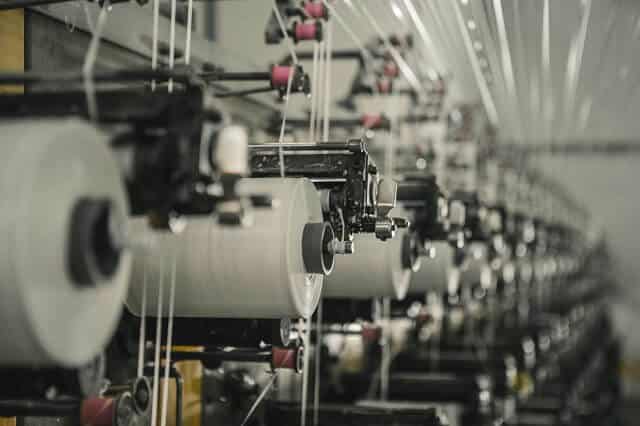

Indonesia’s textile and textile products industry, one of the country’s most labour-intensive manufacturing sectors, is struggling to regain momentum as growth slowed sharply in the third quarter of 2025, underscoring the need for policy reform and technological upgrading to remain competitive.

The sector employs about 3.75 million workers, accounting for more than 19% of Indonesia’s manufacturing workforce, and generated export earnings of roughly US$6.92 billion. Yet official data showed TPT gross domestic product growth of just 0.93% year on year in the July–September period, reflecting weak demand, rising costs and intensifying competition from overseas producers.

Also Read: Mini Garments Owners Community Meet-up 2025 Held Successfully

“The textile and textile products industry can be considered a sunset industry,” Dida Gardera, acting deputy for industry, labour and tourism coordination at the Coordinating Ministry for Economic Affairs, said in Jakarta on Wednesday. He pointed to the decline of textile outlets in Bandung since their peak in the 1980s and 1990s as a sign that the industry has lagged in technology adoption and competitiveness compared with regional peers.

Against this backdrop, the Coordinating Ministry for Economic Affairs and policy think tank Prospera convened a Strategic Policy Forum to discuss a new study titled Pathways for Sustainable and Globally Competitive Textile and Apparel Industry Development. The study argues that despite current pressures, Indonesia’s textile sector still has room to grow by shifting toward higher-value garments and sustainable materials, segments that are gaining traction in global markets.

Also Read: US Small Business Optimism Index Rises in November

The report also identifies persistent structural challenges, including skills mismatches in the workforce, heavy reliance on imported raw materials, high energy and logistics costs and weak integration between upstream, midstream and downstream supply chains. External risks, such as China’s excess production capacity and dumping practices, continue to weigh on domestic producers.

The study sets out 20 policy recommendations clustered around four pillars, calling for a more integrated approach to industry development. Key priorities include tighter import governance to protect the domestic market, support for meeting international sustainability standards, better use of the Indonesia–EU Comprehensive Economic Partnership Agreement to access European markets and a strategic focus on high-value apparel and sustainable textiles.

Also Read: Dutch Manufacturing Output Rises in October Despite Weaker Confidence

Policymakers say the recommendations are intended to help reposition the sector from cost-driven manufacturing toward higher productivity and value creation, as Indonesia seeks to preserve jobs while boosting competitiveness in a crowded global textile market.