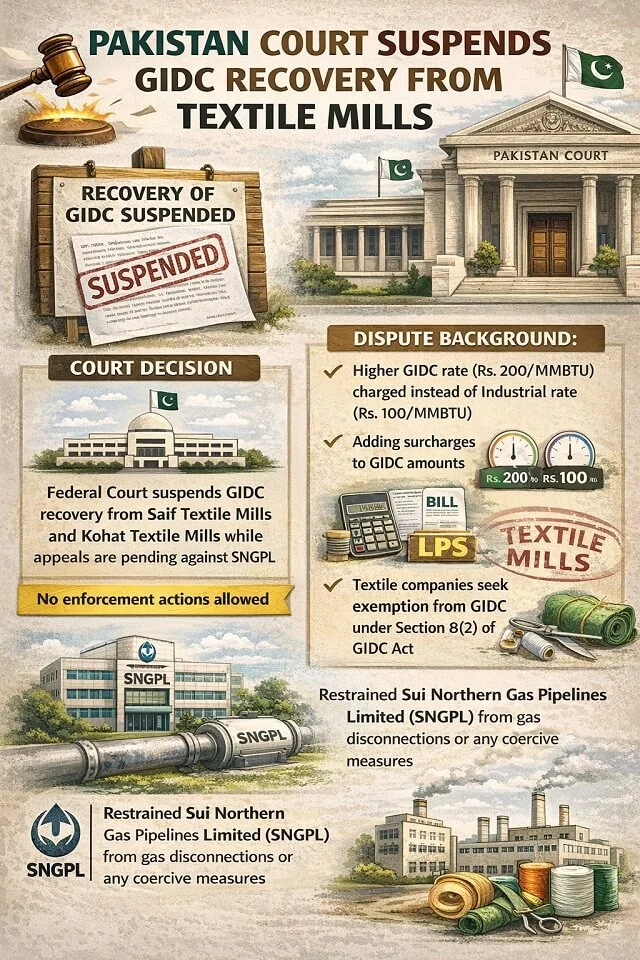

Pakistan’s Federal Constitutional Court has temporarily suspended the recovery of charges under the Gas Infrastructure Development Cess (GIDC) Act, 2015 from Saif Textile Mills and Kohat Textile Mills, providing interim relief to two industrial gas consumers amid broader disputes over energy taxation in the country’s manufacturing sector.

The court also restrained state-run Sui Northern Gas Pipelines Ltd (SNGPL) from taking coercive measures, including gas disconnections, while it hears appeals against a September 2025 ruling by the Peshawar High Court that had upheld the recovery of GIDC dues.

GIDC is a levy imposed on industrial and commercial users of natural gas to help finance major infrastructure projects such as gas pipelines and liquefied natural gas terminals. For energy-intensive sectors like textiles, the cess is charged in addition to regular gas tariffs, making it a significant component of production costs.

Lawyers for the petitioning mills argued that SNGPL applied higher GIDC rates meant for captive power generation instead of the lower rates applicable to industrial consumers, a practice they say is inconsistent with the law. The companies also challenged the imposition of backdated dues, penalties and mark-up on alleged arrears, contending that such charges amount to unlawful retrospective taxation.

Also Read: Pakiza Knit Group Joins Witt-Gruppe Supplier Summit 2026

Textile and industrial firms have repeatedly challenged GIDC in court over the past decade, citing inconsistent classification, delayed billing and restrictions on passing the cost on to buyers. Industry groups argue that sudden recovery demands can disrupt cash flows and undermine competitiveness, particularly in export-oriented sectors already facing high energy prices and global market pressures.

The FCC’s interim order offers short-term financial relief to the two mills by easing immediate payment obligations and ensuring uninterrupted gas supply. Analysts say the decision could prompt other industrial users with similar disputes to seek judicial intervention, potentially slowing government efforts to collect outstanding GIDC revenues.

For Pakistan’s textile sector, which accounts for more than half of the country’s exports, the ruling could temporarily reduce cost pressures and improve liquidity. However, legal uncertainty remains, as companies may still face future liabilities depending on the final outcome of the case, complicating long-term financial planning for manufacturers.