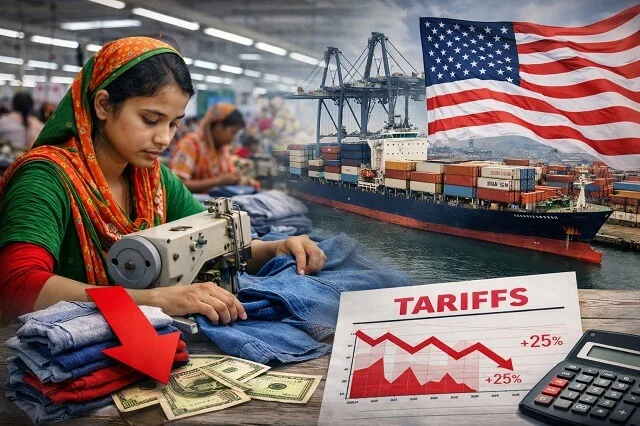

Bangladesh’s ready-made garment exports to the United States fell in both value and volume in November 2025 from a year earlier, as higher tariffs and softer consumer demand weighed on orders from the country’s largest single export destination.

Data from the Export Promotion Bureau (EPB) showed Bangladesh’s overall merchandise exports totaled about $3.89 billion in November, down roughly 5.5 percent compared with the same month a year earlier. Garment shipments, which account for more than 80 percent of national export earnings, stood at around $3.14 billion, marking a near 5 percent year-on-year decline.

Industry officials said the contraction was largely driven by weaker shipments to the United States, where buyers adjusted sourcing plans after facing higher import tariffs in 2025. Exporters reported that U.S. retailers reduced order volumes, sought price concessions and delayed confirmations for upcoming seasons, leading to a fall in both export receipts and physical shipment volumes.

The decline represents a sharp turnaround from the strong growth recorded earlier in the year. According to U.S. trade data, Bangladesh’s ready-made garment exports to the United States rose more than 15 percent in value during the January–October 2025 period compared with the same period in 2024, exceeding $7 billion. Shipment volumes also increased during that stretch, supported by steady replenishment demand and Bangladesh’s competitive pricing in basic apparel categories.

Analysts say the November drop reflects the cumulative impact of tariff adjustments and weaker end-market conditions in the United States. With American consumers facing persistent inflation and tighter household budgets, discretionary spending on clothing has remained uneven. Retailers have responded by managing inventory more cautiously, reducing bulk orders and shifting toward shorter production cycles.

The United States remains Bangladesh’s largest single-country market for garments. In 2024, Bangladesh’s total ready-made garment exports were estimated at around $38.5 billion, of which roughly $7.2 billion went to the U.S. market, accounting for close to one-fifth of total sector earnings. The heavy reliance on the U.S. underscores the sector’s vulnerability to shifts in trade policy and demand fluctuations in that market.

Also Read: Bangladesh Apparel Exports Grow as Turkey Factories Shut

Exporters said that beyond tariff pressures, changes in buyer behavior have contributed to volatility. Many factories reported operating below optimal capacity in November as U.S. clients reassessed sales forecasts and inventory levels ahead of the year-end retail season. Smaller and mid-sized manufacturers were particularly exposed, given their dependence on a limited number of U.S. buyers.

At the same time, competition among major apparel exporters has intensified. Countries such as Vietnam and India continue to expand their presence in the U.S. market, while China remains a significant supplier despite ongoing trade tensions. Earlier in 2025, Bangladesh benefited from some sourcing diversification away from China, but the latest figures suggest that tariff-driven cost pressures are now affecting a broader range of suppliers.

Despite the setback in November, Bangladesh’s overall garment export performance in fiscal year 2024-25 remained resilient. Official data indicate that total RMG export earnings reached nearly $39.4 billion during the fiscal year, reflecting growth of close to 9 percent compared with the previous year. Stronger shipments to the European Union and several non-traditional markets helped offset emerging weakness in the United States.

Economists say the near-term outlook for Bangladesh’s garment exports to the U.S. will depend on the trajectory of American consumer demand, inventory cycles and any further adjustments to tariff policy. A stabilization in retail sales could support a recovery in orders in early 2026, but prolonged tariff pressures or renewed weakness in discretionary spending could extend the slowdown.

Industry leaders have called for accelerated market diversification, improved productivity and deeper engagement in trade negotiations to mitigate tariff impacts. As Bangladesh prepares for its graduation from least developed country status, strengthening competitiveness and reducing reliance on a single major market are seen as critical to sustaining long-term growth.

For now, the November figures highlight the sensitivity of Bangladesh’s ready-made garment sector to global trade shifts, with higher U.S. tariffs and subdued demand combining to dampen export momentum in its most important overseas market.