Bangladesh is strengthening its position as a leading global garment exporter as Turkey’s textile and apparel industry faces mounting closures, job losses and declining exports, particularly to the European Union.

Industry estimates show Bangladesh now accounts for around 20 percent of EU garment imports, while Turkey’s share has fallen below five percent. The divergence highlights how cost pressures are reshaping global apparel sourcing.

In Turkey, the impact is visible on factory floors. Sıkı Makas, a denim producer that previously supplied European fashion brands, has been forced to cut production as buyers moved orders to Bangladesh and other low-cost countries. Similar stories are playing out across Turkey’s textile regions, where rising inflation, energy costs and borrowing rates have squeezed margins.

Bangladesh’s apparel sector exports more than 40 billion dollars annually and employs over four million workers, making it central to the country’s economy. Competitive labour costs, large-scale production and long-term relationships with Western brands have helped factories maintain capacity even as global demand slows.

Also Read: Bangladesh Garment Industry Seeks Urgent Government Aid

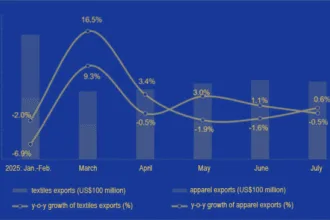

Turkey’s combined textile and clothing exports, by contrast, have fallen to under 20 billion dollars, down more than one-fifth from their peak. Monthly wages in Turkey’s garment sector are several times higher than those in Bangladesh, limiting Turkey’s ability to compete for basic and mid-range orders that dominate global trade.

Bangladesh has also strengthened factory safety, compliance and environmental standards over the past decade, reducing reputational risks for buyers and supporting its rise as a preferred sourcing destination.

Analysts say the contrasting fortunes of companies like Sıkı Makas and Bangladesh’s expanding manufacturers illustrate a wider shift in the global apparel industry, where scale and cost efficiency increasingly outweigh proximity to market. As brands continue to prioritise price, Bangladesh is expected to consolidate its gains, while Turkey faces growing pressure to move into higher-value and specialised production.