Bangladesh is considering raising cash incentives for garment exports made with locally produced yarn, a move aimed at easing pressure on struggling spinning mills and stabilising the country’s textile and apparel sector, officials and industry leaders said.

The Ministry of Finance has given initial consent to an additional 3.5 percent cash incentive, which would raise the current support for exporters from 1.5 percent to a total of 5 percent. The proposal was discussed at a meeting held on February 3 at the finance ministry, attended by Finance Secretary Khairuzzaman Mozumder, Commerce Secretary Mahbubur Rahman, and representatives from the Bangladesh Textile Mills Association (BTMA) and the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA).

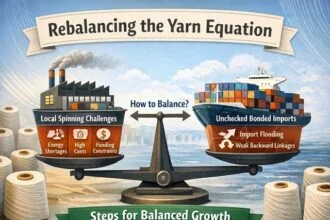

The move comes at a time when Bangladesh’s textile and garment industries, the backbone of the country’s economy, are grappling with slowing exports, rising inventories, and financial stress across the supply chain. Spinning mills in particular have been hit hard by weak demand, high production costs, and competition from imported yarn, leaving many factories operating below capacity or facing potential closure.

Industry stakeholders say the proposed incentive increase would encourage garment manufacturers to source more yarn domestically rather than relying on imports, thereby boosting demand for locally produced yarn and improving cash flow for spinning mills. Exporters currently receive a 1.5 percent cash incentive on shipments, but industry groups argue that this level is no longer sufficient to offset rising costs and weakening global demand.

Before finalising the proposal, the government has formed a 10-member committee to assess domestic and international market conditions. The committee includes representatives from the ministries of finance and commerce, as well as from BTMA, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), and BKMEA. It is expected to submit its recommendations within the next 10 working days, after which a final decision will be taken.

On the same day as the incentive discussion, the finance secretary announced that the government would release Tk 2,500 crore in outstanding cash incentives for the garment sector within the coming week. The total backlog of unpaid incentives in the sector currently stands at around Tk 6,000 crore, according to industry estimates. Exporters have long complained that delayed payments have strained liquidity, disrupted production planning, and weakened their ability to compete in global markets.

BKMEA Executive President Fazle Shamim Ehsan said the remaining transition period before Bangladesh’s graduation from least developed country status was critical, as direct cash incentives would no longer be permitted once the country exits the LDC category. He said exporters were seeking higher incentives during this window to cushion the impact of falling exports, rising inventories, and growing competition from regional rivals.

“With only about seven months left, we need maximum support to remain competitive and keep factories running,” Ehsan said. “Once LDC graduation takes effect, the scope for direct export incentives will be severely limited.”

Although there is broad agreement among industry stakeholders on the proposed 3.5 percent increase, differences remain over BTMA’s proposal to withdraw bonded warehouse facilities for imported yarn in the 10 to 30 count range. Spinning mills argue that such imports undercut domestic producers and discourage local sourcing, while garment manufacturers say access to bonded facilities is essential to maintain supply chain flexibility, manage costs, and meet buyer specifications.

Because of these unresolved issues, the government has referred the matter to the committee, and officials said a resolution is unlikely within the current government’s term. Industry leaders warned that prolonged uncertainty could further undermine confidence in the sector at a time when stability is urgently needed.

BTMA Director Khorshed Alam said the proposed incentive could provide temporary relief to the textile sector but stressed that deeper structural problems remained. He warned that illegal imports of yarn from neighbouring countries, often carried out through forged documents and false declarations, were severely hurting local mills by depressing prices and eroding market share.

“Illegal imports typically rise ahead of Eid, when demand increases,” Alam said. “Unless these practices are effectively curbed, any incentive will only offer short-term relief, and the sector’s difficulties will persist.”

Meanwhile, tensions between textile and garment sector associations have intensified in recent weeks, spilling into public disputes and press conferences. BGMEA Vice President Shihab Uddoja Chowdhury attributed much of the friction to actions taken by the commerce secretary, alleging that recommendations to remove bonded facilities for yarn imports were made without consulting BGMEA and BKMEA, despite their direct involvement in yarn consumption.

He said exporters had been taken by surprise by proposals that could significantly affect their sourcing strategies and production costs, and called for greater coordination and dialogue between policymakers and industry stakeholders.

Chowdhury also said Bangladesh’s garment exports had declined for six consecutive months, an unprecedented trend, reflecting weakening demand in key markets such as the United States and Europe, as well as rising competition from countries like Vietnam, India, and Cambodia.

“Six months of continuous decline is something we have never seen before,” he said. “If this continues, many small and medium-sized factories will not survive.”

BGMEA has sought access to low-interest loans and faster disbursement of government incentives to prevent factory closures, protect jobs, and maintain Bangladesh’s position as one of the world’s leading apparel exporters. The sector employs more than four million workers, most of them women, and accounts for over 80 percent of the country’s export earnings.

Also read: Garment Giants Push Back on Yarn Import Policy

Economists and trade analysts say the proposed incentive reflects growing concern within the government about the health of the textile and garment sector and its broader implications for the economy. While export incentives can provide short term relief, they caution that long term competitiveness will depend on improvements in productivity, energy efficiency, infrastructure, and compliance with environmental and labour standards.

They also note that as Bangladesh prepares for LDC graduation, the country will lose preferential market access in key destinations, making cost competitiveness and value addition even more critical. Encouraging greater use of locally produced inputs such as yarn could help deepen domestic value chains and reduce vulnerability to external shocks.

For now, industry leaders say they are cautiously optimistic that the proposed incentive, if approved, will provide much-needed breathing space for spinning mills and garment exporters alike. But they warn that without swift implementation, stronger enforcement against illegal imports, and broader policy support, the sector’s challenges will continue to mount in the months ahead.