The global fashion industry could lose up to 34% of its profits by 2030 and as much as 67% by 2040 as climate-related costs accelerate, according to a new analysis released by the Apparel Impact Institute, underscoring mounting financial risks for brands and suppliers worldwide.

The report finds that rising carbon prices, higher energy costs, raw material volatility and physical climate disruptions are already reshaping the industry’s cost base. Without rapid investment in decarbonization and supply chain resilience, the sector faces what the institute describes as a structural erosion of profitability over the next decade.

Lewis Perkins, president and chief executive of the Apparel Impact Institute, said climate change is no longer a long-term scenario risk but a near-term financial reality. Companies are absorbing escalating costs tied to extreme weather events, water scarcity, heat stress and regulatory changes, often without fully accounting for them in financial planning, he said in comments carried by multiple media outlets.

The fashion sector, valued at roughly $1.7 trillion to $1.8 trillion globally, operates on relatively thin margins and relies heavily on complex international supply chains concentrated in climate-vulnerable regions. Manufacturing hubs in South and Southeast Asia face intensifying floods, cyclones and prolonged heatwaves that disrupt factory operations, damage infrastructure and reduce worker productivity.

Beyond physical risks, transition risks are adding pressure. Expanding carbon pricing mechanisms in Europe and other markets, along with measures such as carbon border adjustment policies, are expected to increase compliance and production costs. Suppliers dependent on fossil fuel-based energy sources could see operating expenses rise further as governments tighten emissions regulations.

Also Read: Stretching Circularity Targets Elastane Recycling Barrier

Raw materials present another vulnerability. Cotton yields are increasingly exposed to drought and erratic rainfall, while synthetic fibers such as polyester remain linked to fossil fuel price swings. Energy-intensive processes including dyeing and finishing are particularly exposed to electricity and fuel price volatility, compounding margin pressure across the value chain.

The analysis also highlights that the majority of fashion emissions fall within Scope 3 categories, meaning they originate in upstream supply chains rather than in brands’ direct operations. This makes decarbonization dependent on collaboration between global brands and manufacturers, many of whom operate in emerging markets with limited access to affordable green finance.

The institute has been promoting blended finance mechanisms, including its Fashion Climate Fund, to accelerate renewable energy adoption and low-carbon technology upgrades in supplier factories. According to the report, proactive climate investment could significantly reduce projected losses and protect long-term enterprise value.

Industry analysts say investors are increasingly factoring climate exposure into valuations. Companies with credible transition strategies may benefit from improved access to capital, while laggards risk higher borrowing costs and potential loss of competitiveness as consumers and regulators demand greater environmental accountability.

The warning comes amid broader evidence that fashion sector emissions remain off track from global climate targets. Previous research has shown emissions rising in recent years due to production growth and continued reliance on virgin polyester, adding urgency to calls for systemic change.

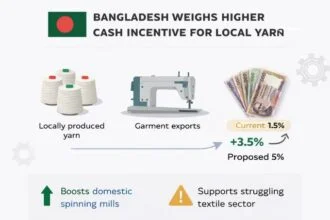

For major apparel-exporting economies such as Bangladesh, Vietnam and India, the stakes extend beyond corporate earnings. Climate-driven disruptions to garment manufacturing could have macroeconomic implications, affecting export revenues, employment and foreign exchange stability.

The Apparel Impact Institute’s analysis frames climate inaction not only as an environmental liability but as a material financial threat to one of the world’s largest consumer industries. With the next five years viewed as critical, the report suggests that the pace of investment in decarbonization and resilience will determine whether the sector absorbs manageable transition costs or faces prolonged economic contraction.