Global Market Overview

The global footwear market is expected to continue expanding through 2026, albeit at a modest pace compared with earlier pandemic-era rebounds. According to market projections, the global footwear market value is forecast to reach approximately USD 313.38 billion in 2026, up from about USD 306 billion in 2025, with further growth expected into the next decade at around 2.4 % CAGR (2026–2035).

Growth drivers include increasing consumer preference for comfort and athleisure footwear, sustainability preferences, and the rising digital channel share of sales, with nearly 40 % of footwear purchases now occurring online.

Luxury and premium segments are also anticipated to grow faster than average; for example, luxury footwear is projected to reach nearly USD 46.8 billion by 2026 driven by millennial purchasing power and brand desirability.

Consumer and Product Trends in 2026

Fashion & Functional Shifts

- Sneaker and athleisure styles remain dominant globally, though specific tastes are evolving—from minimalism toward more expressive designs and performance-oriented features.

- Practical, multifunctional footwear (e.g., weatherproof and comfort-driven designs) is becoming increasingly important as consumers balance style with utility.

Sustainability & Material Innovation

Brands are accelerating the shift from sustainability as a marketing narrative to standard practice. Footwear production increasingly uses recycled, bio-based materials, advanced vegan leather alternatives, and circular design principles to minimize waste and meet consumer expectations for ethical products.

Technology Adoption

Digital tools such as AR try-on experiences, AI-driven customization, and production technologies like 3D printing are expected to reshape both design and retail experiences by 2026, enhancing customer engagement and supply chain efficiency.

Slower Segment Growth and Competitive Pressure

Major global brands like Adidas and Birkenstock have reported softening growth outlooks and margin pressures due to market saturation, shifting demand, and impacts from trade policies and tariffs.

As casual footwear demand shifts with post-pandemic lifestyle changes (e.g., return to formal workplaces), some legacy segments are underperforming, prompting brands to pivot toward performance and sustainable categories.

Also Read : National Conference on Future Fabrics to Spotlight Natural and Bio-Based Textile Innovation

Regional Dynamics

The Asia-Pacific region continues to hold a large share of global footwear production and consumption, driven by rapid digital adoption, expanding middle classes, and strong e-commerce channel growth.

North America and Europe remain important markets, particularly for athleisure and premium footwear, though tariff changes and cost pressures may influence sourcing strategies and retail pricing.

Export Performance & Growth Potential

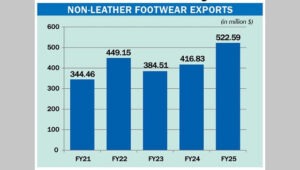

Bangladesh’s footwear sector has shown robust export growth, especially in both leather and non-leather segments. In FY 2024-25, non-leather footwear exports increased by over 30 % year-on-year, while leather footwear exports rose nearly 29 %, totalling significant export earnings across both categories.

This performance reflects rising global demand for affordable, fashionable, and sustainable footwear, as well as Bangladesh’s competitive labor costs, improving factory capacity, and expanding export diversification beyond traditional garment manufacturing.

Market Forecast and Domestic Growth

Domestic footwear market forecasts indicate continued growth, with Bangladesh’s footwear market expected to reach approximately USD 4.57 billion in revenue by 2025, and 0.4 % volume growth projected in 2026.

Boots and other segments are also part of this broader market expansion. The non-leather segment driven by rubber, plastic, and textile materials—is rapidly emerging as a core export focus, accounting for the majority of Bangladesh’s international shipments and positioning the country as a competitive regional hub.

Opportunities and Strategic Priorities

Key opportunities for Bangladesh in 2026 center on moving the footwear industry beyond its traditional, apparel-linked export base and into a more diversified and resilient growth model.

Export diversification into a wider range of footwear categories can reduce dependency on a narrow product mix while capturing demand from value, mid-market, and sustainable segments.

At the same time, upgrading product quality, regulatory compliance, and end-to-end supply chain transparency will be critical to meeting increasingly stringent buyer expectations and customs requirements.

Bangladesh is also well positioned to leverage global shifts toward sustainable and non-leather footwear, aligning its production capabilities with changing consumer preferences and brand sourcing strategies.

These efforts can be further strengthened by attracting foreign investment in raw materials, components, and modern production capacity, improving both efficiency and competitiveness.

Supporting this transition, the government has identified footwear as a priority sector and is promoting growth through targeted infrastructure development, industrial zones, and policy incentives.

Final Notes

2026 will be a year of measured progress for the global footwear industry—anchored by expanding categories like athleisure, sustainable materials, and digital engagement, but tempered by competitive pressures and shifting consumer priorities.

Bangladesh’s footwear sector is well-positioned to capitalize on export momentum, particularly in non-leather and value-oriented segments, provided it continues to align with global quality and compliance standards.