Balancing Market Access, Competitive Pressures, and Structural Transformation to Sustain Global Leadership Beyond 2026

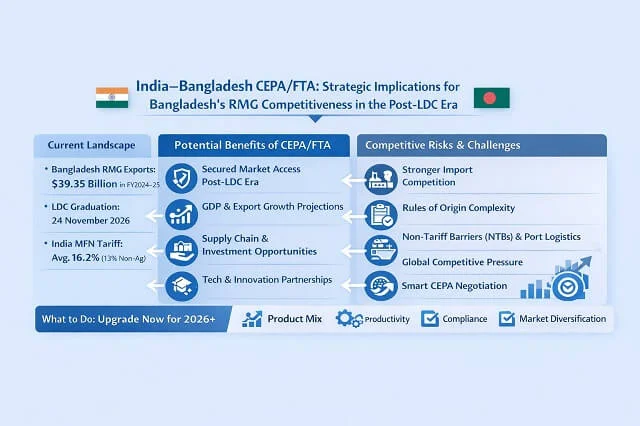

Bangladesh’s apparel industry is entering a “preference transition” decade, shaped by two simultaneous developments. First, Bangladesh’s planned graduation from Least Developed Country (LDC) status on 24 November 2026 will gradually tighten or remove today’s preferential access to major markets. Second, a bilateral trade deal with India—often discussed as a Comprehensive Economic Partnership Agreement (CEPA), similar in effect to an FTA but broader in scope—could protect and expand access to a very large neighboring market while enhancing regional supply-chain integration.

Below is a business-focused assessment of potential positive and negative impacts, alongside initiative plans for Bangladeshi apparel manufacturers and the broader RMG ecosystem to maintain global competitiveness.

1) Baseline: where Bangladesh’s RMG stands today (data snapshot)

Bangladesh’s RMG exports reached US$39.35 billion in FY2024–25, reflecting an 8.84% year-on-year increase according to Export Promotion Bureau country-wise data. The industry remains heavily reliant on preferential access in key destinations, with the EU’s “Everything But Arms (EBA)” arrangement currently providing duty-free, quota-free access for LDCs, including Bangladesh. In India, applied duties remain significant across sectors; India’s 2024 simple average MFN applied tariff stands at approximately 16.2% overall, with around 13% for non-agricultural goods, highlighting why preferential terms or tariff elimination could materially improve competitiveness.

Also Read: Lessons from 2025: Why Diversification Mattered—and What 2026 Demands

2) Potential positive impacts of an India-Bangladesh FTA/CEPA for apparel

A CEPA could secure post-LDC market access and support demand diversification. Even though India is not currently Bangladesh’s largest RMG destination, a rules-based, tariff-reducing agreement would help diversify markets—a factor that becomes increasingly important as preferences erode in traditional markets after 2026. With the LDC graduation timeline now fixed, this becomes a critical planning anchor.

Joint and related studies suggest GDP, export, and welfare gains. Feasibility studies and reports on the Dhaka–Delhi CEPA indicate Bangladesh’s GDP could rise by approximately 1.72%, with India seeing a smaller increase of around 0.03%. Some projections also estimate very large percentage increases in bilateral exports from a low base. While these figures depend on assumptions, they indicate that reduced tariffs and lower trade costs would support Bangladesh’s economy.

Regional integration under a CEPA could strengthen supply-chain resilience and reduce costs. Lower duties and smoother customs procedures would allow faster sourcing of inputs such as yarn, fabric, chemicals, and machinery parts. Improved connectivity and logistics—including border management, port efficiency, and transit facilitation—would directly enhance lead-time competitiveness, an increasingly important KPI for buyers. Trade-cost reductions are consistently highlighted as key amplifiers of these benefits.

Investment and technology transfer opportunities are additional potential advantages. CEPA frameworks typically include provisions for investment, services, standards, and dispute mechanisms, which can encourage Indian-Bangladeshi joint ventures in man-made fibers (MMF), performance wear, and textiles. They also create pathways for technology upgrades, including automation, quality labs, and digital compliance, all of which improve productivity per production line.

3) Potential negative impacts and competitive risks

However, a CEPA could also introduce challenges. Tariff reductions are reciprocal, meaning that Bangladesh may face stronger import competition from Indian textiles, apparel, accessories, and value-added consumer goods. This is particularly significant for small and mid-sized local producers if safeguard measures and phase-outs are not carefully negotiated.

Rules of origin (RoO) complexity could limit the real benefits of the agreement. Strict RoO requirements, such as yarn-forward or fabric-forward equivalents, may hinder Bangladesh’s ability to fully utilize preferences in segments that still rely heavily on imported inputs.

Also Read: EU Ends GSP for India, Seals FTA in Major Trade Shift

Non-tariff barriers (NTBs) and port or logistics restrictions could further erode advantages. Even with tariff preferences, procedural barriers and port restrictions can increase time and cost, potentially offsetting the benefits of the CEPA. Bangladeshi exporters have previously expressed concerns about Indian port curbs affecting RMG shipments.

Global competitive pressure is another factor. India’s trade agreements with other major markets, such as the EU–India deal, could reduce EU tariffs on Indian apparel and textiles from around 9–12% to zero, tightening competition in markets where Bangladesh is highly exposed.

Finally, post-LDC tariff exposure in core markets remains a risk. After graduation, Bangladesh may encounter higher tariffs and stricter rules of origin in some markets compared to today’s EBA access. Policy briefs and transition documents highlight apparel tariff increases and tougher origin requirements as key challenges.

4) What Bangladeshi apparel manufacturers and the RMG sector should do now (initiative plan)

To remain competitive, manufacturers and industry bodies should act now, regardless of the CEPA signing date. A move up the value curve over the next 12–24 months is essential, reducing overdependence on basic cotton items and expanding higher-margin, higher-compliance categories. Scaling MMF, performance, athleisure, outerwear, and functional workwear, while building capabilities in design-for-manufacturing, quick-turn sampling, and smaller MOQs, can mitigate the risks posed by preference erosion and new competitors in basic low-margin segments.

Productivity and cost transformation at the factory level is also crucial. Implementing line balancing, industrial engineering digitization, defect reduction (right-first-time), and SMV control, alongside selective automation in cutting, spreading, finishing, and material handling where the payback is clear, can generate measurable efficiency gains. Expected outcomes include 8–12% higher output per line, 15–25% reductions in rework, and shorter lead times.

RoO readiness should be prioritized through backward linkages and smarter sourcing strategies. Expanding local and regional fabric capacity where feasible, securing long-term contracts for compliant inputs, and creating a RoO dashboard per style detailing yarn and fabric origins, processing steps, and documentation can maximize the utility of post-LDC and CEPA-related preferences.

Compliance should be leveraged as a competitive advantage rather than seen as a cost. Energy efficiency, renewable energy adoption, wastewater standards, chemical management aligned with ZDHC, and traceability, along with strong social compliance systems and rapid remediation, can secure preferred-supplier status as buyers increasingly prioritize ESG standards.

A strategic approach to market and customer diversification between 2026 and 2030 is essential. Reducing concentration risk in EU and US markets while protecting top accounts, expanding sales efforts into India (if CEPA is realized), East Asia, the Middle East, and emerging EU categories, and offering short-lead-time capsule programs alongside deeper assortment programs can help safeguard and grow market share.

Finally, sector-wide negotiation priorities for industry bodies and government stakeholders should focus on phased liberalization with safeguard clauses for sensitive domestic segments, simple and workable RoO requirements supported by digital verification, NTB and port facilitation with measurable service-level commitments, and trade facilitation measures including faster customs clearance and mutual recognition of standards and testing where possible.

5) What to say in a boardroom: a clear conclusion

A well-structured India–Bangladesh CEPA/FTA can deliver net benefits to Bangladesh’s RMG sector if it preserves or expands market access in a post-LDC world, reduces trade costs, and is complemented by factory productivity improvements and RoO readiness. At the same time, it could increase domestic competitive pressures and deliver limited benefits if rules of origin are overly strict or non-tariff barriers remain. The winning strategy is to treat CEPA as an accelerator rather than a rescue: upgrading product mix, productivity, compliance, and supply-chain depth now will enable Bangladesh to compete effectively even when tariffs are no longer in its favor after 24 November 2026.

About the Author

Sk. Mamun Ferdoush is a seasoned textile and apparel professional, currently serving as General Manager at Masco Group, one of Bangladesh’s leading knit composite conglomerates. With over two decades of experience across marketing, merchandising, and production, he has played a pivotal role in strengthening Masco’s global presence. An alumnus of the Bangladesh University of Textiles and Primeasia University, he combines deep technical expertise with strategic leadership.

Beyond his corporate role, he also contributes to academia as a Guest Speaker at the Institute of Business Administration (IBA), University of Dhaka) and the Bangladesh University of Textiles , sharing his industry insights with future leaders.