Global cotton production is set to decline this season, according to the International Cotton Advisory Committee’s (ICAC) latest Cotton This Month report, underscoring the growing importance of traceability across supply chains.

The September outlook pegs world output at 25.5 million tonnes, down from last month’s 25.9 million. The cut stems mainly from declines in the United States (–400,000 tonnes), Pakistan (–100,000 tonnes), and Sudan (–50,000 tonnes).

Cotton This Month – September 2025

🌎 Global Production Down

- 25.5 million tonnes (from 25.9 Mt last month)

- ↓ U.S. –400,000 t

- ↓ Pakistan –100,000 t

- ↓ Sudan –50,000 t

🔄 Trade Shifts

China’s share of U.S. cotton exports:

- 2023/24: 40%

- Now: 8%

- Growing markets: Vietnam, Pakistan, Turkey, India

💵 Price Outlook (2025/26)

- Range: 60–96¢/lb

- Midpoint: 76¢/lb

- USDA Upland Price: 64¢/lb

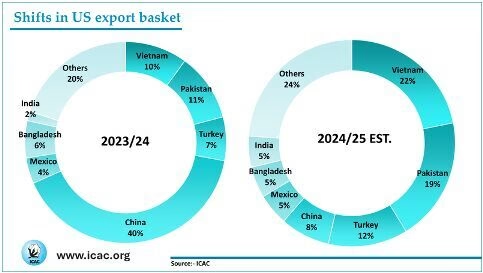

While global consumption and trade volumes remain largely stable, shifts in export destinations are reshaping trade dynamics. The U.S. has sharply reduced shipments to China, which took 40 percent of U.S. cotton in 2023/24, but now accounts for only 8 percent. Exports have instead expanded to Vietnam, Pakistan, Turkey and India.

Also Read: US Cotton Futures Sink on Strong Crop Outlook, Oil Weakness

At the policy level, a recent U.S. executive order allows products made with U.S. raw cotton to bypass import tariffs, provided textile manufacturers can verify traceability. That requirement aligns with mounting pressure from retailers and brands, which are increasingly demanding supply-chain visibility in line with sustainability and compliance goals.

Prices are expected to remain volatile. ICAC projects the 2025/26 season’s price range at 60–96 cents per pound, with a midpoint of 76 cents. Complementary data from USDA shows similar downward adjustments in global production, with U.S. output trimmed to 13.2 million bales and the Upland price revised up to 64 cents per pound.

For mills, traders and apparel buyers, the twin forces of tightening supplies and stricter traceability rules could redefine sourcing strategies for the season ahead.