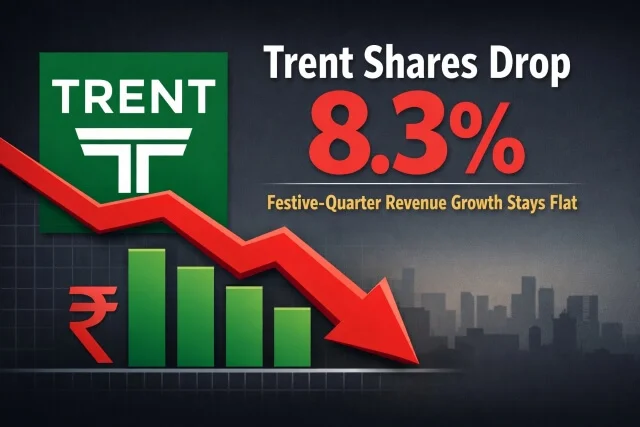

Shares of India’s Trent fell sharply on Tuesday after the Tata Group-controlled apparel retailer signalled that revenue growth remained flat even during the key October–December festive quarter, disappointing investors who had priced in stronger momentum.

Trent, one of the key retail arms of the Tata Group, has aggressively expanded its store network in recent years, with Zudio emerging as a major growth driver in the affordable fashion space. However, Tuesday’s sharp sell-off underscores growing investor caution over whether the retailer can sustain its earlier pace of growth in a more challenging consumer environment.

Trent’s stock dropped as much as 8.3% to ₹4,060.65 in intraday trade on the BSE, making it the top loser on the benchmark Nifty 50 index, which was down about 0.2% at the time. The decline erased a significant portion of recent gains in a stock that had been a market favorite during its rapid expansion phase.

The operator of Westside and fast-fashion brand Zudio reported standalone revenue of ₹52.20 billion ($579.3 million) for the three months ended December, up 17% from a year earlier. However, the growth rate was unchanged from the previous quarter, despite the period typically benefiting from festive and year-end shopping demand.

Also read: China–Vietnam Rail Freight Jumps 86% in 2025, Hits Record 37,000 TEUs

Analysts said the lack of acceleration in sales growth raised concerns about moderation in consumer spending and rising competitive pressure in India’s crowded value fashion segment. “It’s a miss,” said Karan Taurani, an analyst at Elara Securities, adding that competition from rivals such as Max Fashion and Style Union continues to intensify.

Brokerage firms also pointed out that the latest performance marked a slowdown from the much higher growth rates seen earlier. Trent had reported revenue growth of 37%, 29% and 20% in the preceding quarters, according to analysts at Morgan Stanley, signalling that the retailer’s breakneck expansion may be cooling.

Shares of Trent have now lost roughly a quarter of their value over the past six months, as investors reassess growth expectations amid tighter discretionary spending and increasing competition in the apparel market. Antique Stock Broking said growth trends appear to be moderating and cut its target price on the stock by more than 14% to ₹5,700.