In recent years, China has witnessed a significant decline in the import of leather footwear, a trend that has raised eyebrows among market analysts and industry leaders alike. However, despite this downturn, projections for the coming years show a steady recovery, with the Chinese leather footwear market expected to grow at a Compound Annual Growth Rate (CAGR) of +1.0% from 2024 to 2035. By the end of 2035, it is estimated that the market volume will reach 904 million pairs, offering optimism for both local producers and international exporters.

This article delves into the reasons behind the decline in imports, the factors contributing to the market’s resilience, and how key players are adapting to changing consumer behavior and market conditions.

The Decline in Leather Footwear Imports

Over the last few years, China has experienced a steady decline in the import of leather footwear, which has been attributed to several key factors. The drop in imports has created a shift in the market dynamics, raising questions about the future of foreign suppliers in one of the world’s largest footwear markets.

Domestic Production Surge

One of the primary reasons for the decline in imports is the strong growth of domestic production. China remains one of the world’s leading producers of leather footwear, with a well-established supply chain and large-scale manufacturing capabilities. As local manufacturers ramp up their output, the reliance on foreign imports has diminished. Moreover, Chinese consumers’ increasing preference for locally made products, driven by the “Made in China” movement, has further boosted domestic production and reduced demand for imported leather shoes.

Changing Consumer Preferences

Another contributing factor to the fall in leather footwear imports is the evolving preferences of Chinese consumers. The younger demographic, particularly Generation Z and Millennials, is more inclined toward sustainable and eco-friendly products. Leather, with its associations to animal farming and environmental impact, is increasingly seen as a less desirable option compared to synthetic or plant-based alternatives.

In response to growing environmental concerns, many international footwear brands are investing in sustainable materials like vegan leather, recycled fabrics, and plant-based alternatives. These new materials are quickly gaining popularity in China, and the shift in consumer demand is further driving down the need for imported leather footwear.

Economic Pressures and Trade Barriers

China’s economic landscape has also played a role in reducing leather footwear imports. Slower economic growth, coupled with inflationary pressures, has made consumers more budget-conscious. As a result, imported leather footwear, which tends to be more expensive than locally produced options, has seen reduced demand.

Moreover, rising trade barriers, tariffs, and geopolitical tensions have made importing goods into China more challenging and costly. Foreign companies face increasingly stringent regulations, higher import duties, and complex logistics, all of which contribute to the declining flow of leather footwear into the country.

Impact of the COVID-19 Pandemic

The COVID-19 pandemic has had a lasting impact on global supply chains and consumer habits. During the pandemic, many consumers in China opted for more affordable and comfortable footwear options, often favoring synthetic materials over leather due to concerns about durability and price. While the immediate effects of the pandemic have waned, consumer habits formed during this period have influenced ongoing preferences, further contributing to the decline in leather footwear imports.

Market Forecast: A Steady Growth Ahead

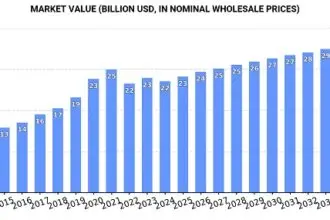

Despite the decline in imports, the overall outlook for the Chinese leather footwear market remains positive, with a projected CAGR of +1.0% from 2024 to 2035. This growth is expected to bring the total market volume to 904 million pairs by 2035, signaling a gradual but consistent recovery.

Several factors are expected to drive this growth, including the evolving demand for leather footwear in domestic markets, as well as the continued diversification of product offerings from local and international brands.

Growth of E-commerce and Online Shopping

The rise of e-commerce in China has significantly changed the way consumers purchase footwear. Online platforms and digital retail channels are expected to play a key role in driving growth for the leather footwear market, as more and more consumers turn to the internet for their shopping needs. Digital platforms provide convenience, competitive pricing, and a wider range of product options, which can boost the demand for both local and international leather footwear brands.

E-commerce also offers an opportunity for smaller brands to reach a broader audience, enabling them to enter the competitive Chinese market without the need for extensive retail infrastructure. As the trend for online shopping continues to surge, it is anticipated that leather footwear imports will benefit from increased visibility and ease of access through these platforms.

Innovation and Sustainability in Leather Footwear

Another key driver of market growth is the ongoing innovation in leather footwear. While traditional leather products may be on the decline, there is increasing demand for new types of leather products, including eco-friendly, sustainable, and cruelty-free footwear options. As brands work to meet this demand, we can expect a surge in the production of alternative leathers and sustainable materials.

These innovations are likely to appeal to China’s growing eco-conscious consumer base, further boosting the demand for leather footwear. Additionally, many international brands are collaborating with local manufacturers to produce sustainable footwear options that meet Chinese consumers’ expectations for both style and environmental responsibility.

Expansion of International Brands in China

Despite the challenges in imports, many global footwear brands are eyeing opportunities to expand their presence in the Chinese market. Established international players such as Nike, Adidas, and Puma are continuing to innovate with new collections that cater to Chinese consumer preferences. These companies are increasingly focusing on sustainability and incorporating advanced technologies into their products to stay competitive.

The growth of the middle class and the rising disposable income in China’s urban centers also presents an opportunity for foreign brands to target the premium segment of the market. While local production remains strong, international brands are leveraging their global reputation and innovative designs to capture the attention of Chinese consumers who are willing to invest in higher-end footwear.

Conclusion

While the decline in leather footwear imports to China may seem concerning at first glance, the broader market outlook remains optimistic. With a projected CAGR of +1.0% from 2024 to 2035, the Chinese leather footwear market is on a path to recovery, driven by the growth of e-commerce, innovations in sustainable products, and the continued demand for both domestic and international footwear brands.

As consumer preferences shift towards eco-friendly and cruelty-free alternatives, the leather footwear industry is evolving to meet these demands. For foreign suppliers, adapting to these changes will be key to maintaining a presence in one of the world’s largest footwear markets.

In the coming years, the Chinese leather footwear market is likely to witness a more balanced relationship between local production and imported goods, with opportunities for both domestic manufacturers and international exporters to thrive in an increasingly competitive and sustainable marketplace.

Also Read: Sri Lanka’s Apparel Industry Gains Momentum as Exports Climb 5.4%